2023

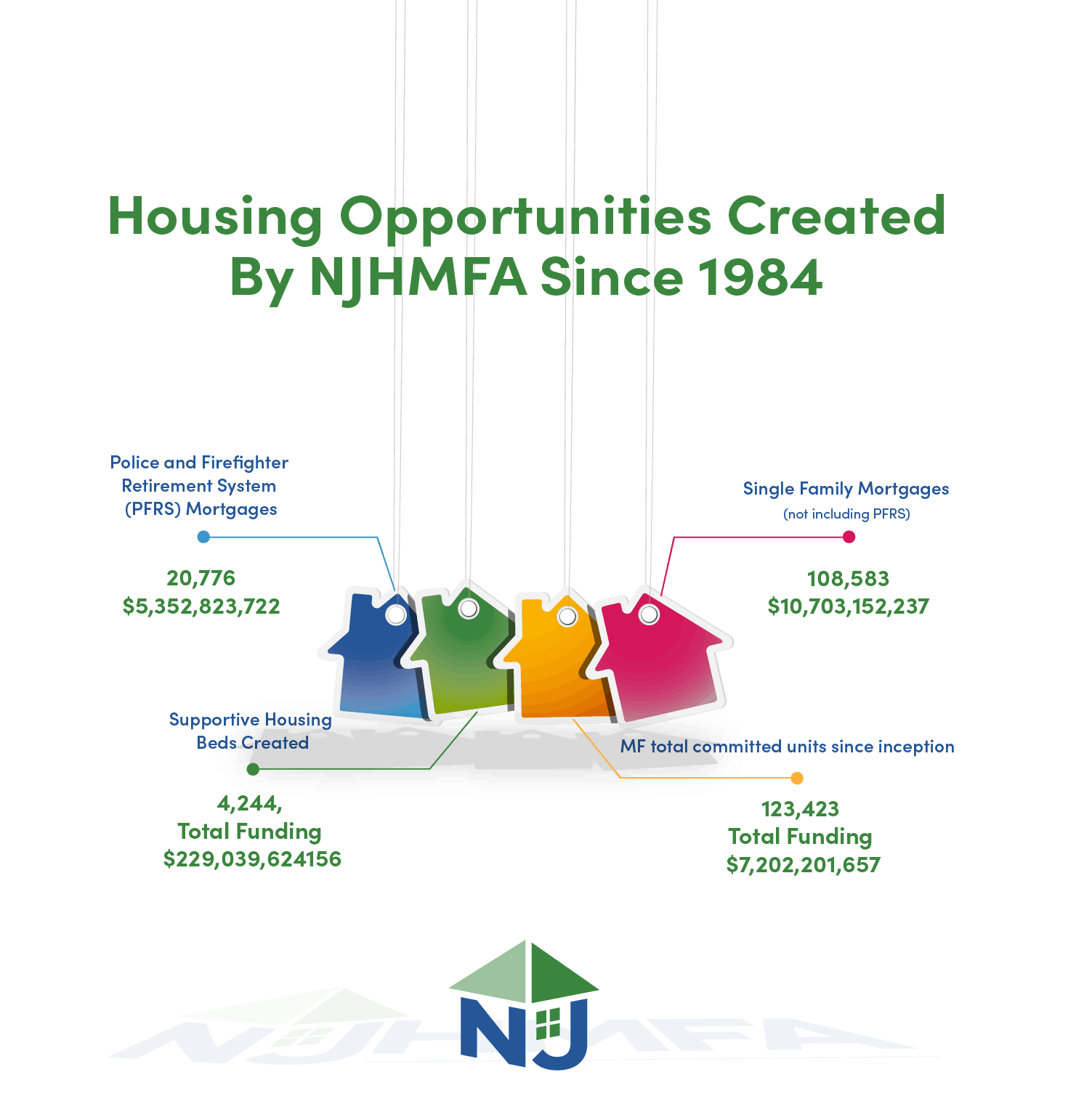

New Jersey Housing and Mortgage Finance Agency (NJHMFA) has catalyzed an unprecedented level of affordable housing production across the state of New Jersey. This work helps New Jersey communities fulfill their housing goals and obligations and offers residents new, high-quality homes affordable to them in the communities they love. The great strides made in 2023 are the culmination of the Agency’s work in its first four decades of operation. In this, the Agency’s 40th year, we pause to reflect on the progress made and to sharpen our focus on the

work ahead.

The Agency in 2023 surpassed its record investment in New Jersey. NJHMFA committed over $1.5 billion in new construction financing to support multifamily production. Every penny supported jobs, homes, and market activity totaling over

$5 billion. Direct gubernatorial and legislative support empowered and shaped programs that propelled the industry out of the COVID-19 slump. In a tough market, we were the engine moving New Jersey affordable housing development forward.

The Agency also put $1 billion dollars to work helping New Jersey families buy their first home in 2023. Our loans went to lower income, more diverse homebuyers across the state than conventional banks, and we grew 20% while the industry ground to a halt in the worst market for new homebuyers in history. We weren’t the lender of last resort; we were the best game in town.

Over $2.5 billion in direct investment in our residents and communities speaks

for itself.

NJHMFA responded to the complexities of a rapidly changing housing landscape

by making strategic investments, deploying innovative financing tools, and implementing bold new policies that kept the industry strong and significantly enhanced the well-being of low- and moderate-income families and communities across the state.

These programs and initiatives honor the steadfast support and leadership of the

late Lieutenant Governor, Sheila Y. Oliver. She amplified the voices of underserved populations and secured unprecedented investments in safe, affordable, and

high-quality housing throughout the state. Her legacy inspires us to press forward with optimism, purpose, and an unwavering commitment to the realization of her vision for affordable housing in every community.

Our Division of Multifamily & Supportive Housing and Lending financed 31 projects through the Low-Income Housing Tax Credit (LIHTC) program, the Conduit Bond Program, and other Agency funding streams. These totaled $801 million in financing commitments, of which $663.1 million supported projects that combined NJHMFA funds and equity from the sale of LIHTC. These projects will expand New Jersey’s supply of affordable housing through the construction or rehabilitation of over 2,000 affordable apartments. 242 special needs beds were financed by NJHMFA’s Special Needs Housing Trust Fund (SNHTF), helping to address the unique needs of residents with disabilities, residents experiencing homelessness, and other vulnerable populations.

NJHMFA also committed another $104.1 million of Affordable Housing Production Fund (AHPF) dollars in 2023, putting the Agency on course to allocate entirety of the original $305 million in program funds by the first quarter of FY2025. The AHPF has supported the construction of an estimated 3,200 new affordable homes, catering to families, seniors, and residents with special needs. It has spurred over $1.3 billion in development and fostered statewide progress amid one of the most challenging construction markets in decades. Through a set aside program within the

AHPF programs.

NJHMFA also saved an additional 24 COVID-19 impacted projects by allocating $66.2 million to ensure that 1,674 in-development units, including 345 special needs beds, are completed and occupied in the months ahead. Forging ahead, NJHMFA introduced two additional multifamily programs in October 2023. The first is the Workforce Housing Program, which will allocate $50 million to create deed-restricted apartments for middle-income workers near mass transit and plentiful job opportunities. The second is the Urban Preservation Program, which will allocate $80 million to preserve existing affordable units that are at risk of deterioration or nearing the expiration of their affordability protections. These historic investments in the State’s housing infrastructure are poised to benefit New Jerseyans for generations.

Each new home transforms someone’s life, but 2023 showed how impactful NJHMFA projects can be in other aspects of family and community life, as well. This past summer, hundreds of new NJHMFA-financed affordable rental homes became available in Paterson, but two award-winning projects stand out: Hinchliffe Residences and Barclay Place. At Hinchliffe, NJHMFA financing enabled 75 low- and moderate-income seniors to live next to the newly revitalized historical landmark, Hinchliffe Stadium, in central Paterson. Additionally, Barclay Place, became the first Hospital Partnership Subsidy Program property to welcome residents home. Barclay Place provides 56 affordable apartments just a block away from St. Joseph’s University Medical Center. These projects demonstrate the unique impact NJHMFA programs can have. NJHMFA uses the tools at its disposal to cultivate housing that is more than shelter- it supports health, well-being, and a high-quality of life for residents and fosters revitalization, environmental stewardship, and intergenerational connections for the host community.

This is what Affordable Housing in New Jersey looks like.

NJHMFA also understands that homeownership is critical to supporting a healthy future for our residents and life cycle for our communities. The Agency strives to empower individuals and families seeking homeownership opportunities to find their dream home and build their lives in a community they love.

Even in this difficult market, it’s working.

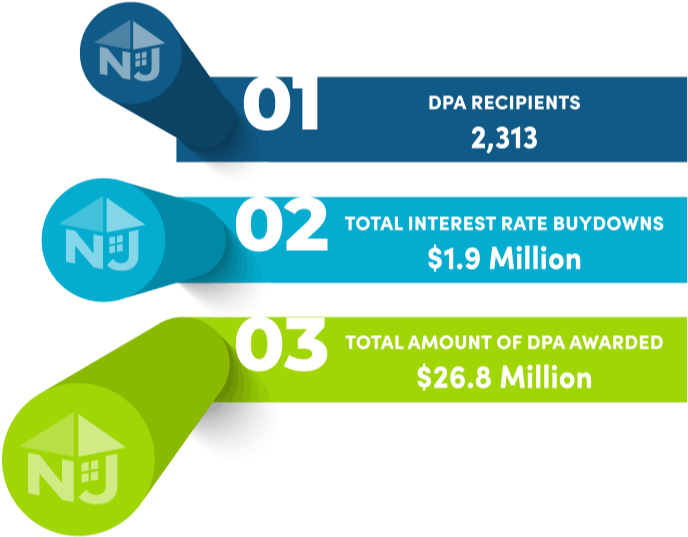

NJHMFA’s single-family programs are thriving. Our Down Payment Assistance (DPA) Program has empowered over 17,000 first-time homebuyers since 2017, helping 2,313 families achieve homeownership in 2023 alone — a 23.36% year-over-year increase. Recent expansion of the assistance available, including increasing the down payment assistance provided in high-cost counties and the legislatively enacted first-generation homebuyer program exemplify our commitment to broadening the Agency’s impact on individuals and families.

Our commitment to supporting homeownership in New Jersey extends past move in day. NJHMFA has distributed over $180 million in Federal HAF funds through the Emergency Rescue Mortgage Assistance (ERMA) program. These funds have helped 5,000 families save their homes. This is a significant contribution to wealth preservation and community stabilization. In 2023 alone, ERMA funds were awarded to 4,091 families, who received $125,287,176 in assistance.

In addition, NJHMFA launched the Foreclosure Intervention Program (FIP) to supplement New Jersey’s single-family housing supply through the rehabilitation of vacant and abandoned homes. This program invests new resources in communities across the State and creates more homeownership opportunities for New Jersey’s low- and moderate- income households.

As we commemorate 40 years at NJHMFA, we remain grateful for your continued support and valuable input as we persist in our mission to transform lives and communities through affordable housing.