2022

2022 was a time of significant change for the affordable housing community.

With public attention and market volatility came both unique financial and operational challenges and a window of opportunity to impact the lives of the many New Jerseyans in need of an affordable place to call home. New Jersey Housing and Mortgage Finance Agency (NJHMFA) met the moment, collaborating across the sector to advance lasting solutions to exigent market conditions as

well aslong-term affordable housing needs.

This 2022 Annual Report offers NJHMFA a chance to provide a retrospective

on the year’s work, reflecting on the major policies and programs developed during this year, some new initiatives moving forward, and the work our development partners have completed during the 2022 calendar year.

NJHMFA is proud of how far we've come and are focused on where we're

going—ever committed to building a stronger, fairer, and more affordable state.

On June 30, 2022, Governor Phil Murphy signed the Fiscal Year 2023 Budget

into law. This annual state budget included a $305 million investment in a new affordable housing production program: the Affordable Housing Production

Fund (AHPF). The program is already off to a solid start. It opened before the

close of the year, and applications streamed in the door, demonstrating the

high demand for affordable housing subsidy resources to help make municipal

fair share plans come to fruition. By 2025, NJHMFA expects this program to finance more than 3,000 new apartment units and to add more than 500 new special needs units, including a set aside for individuals transitioning out of homelessness. In total, the AHPF will help double the state's multi-family

housing production over the next three years and will create thousands of

housing opportunities for New Jersey families.

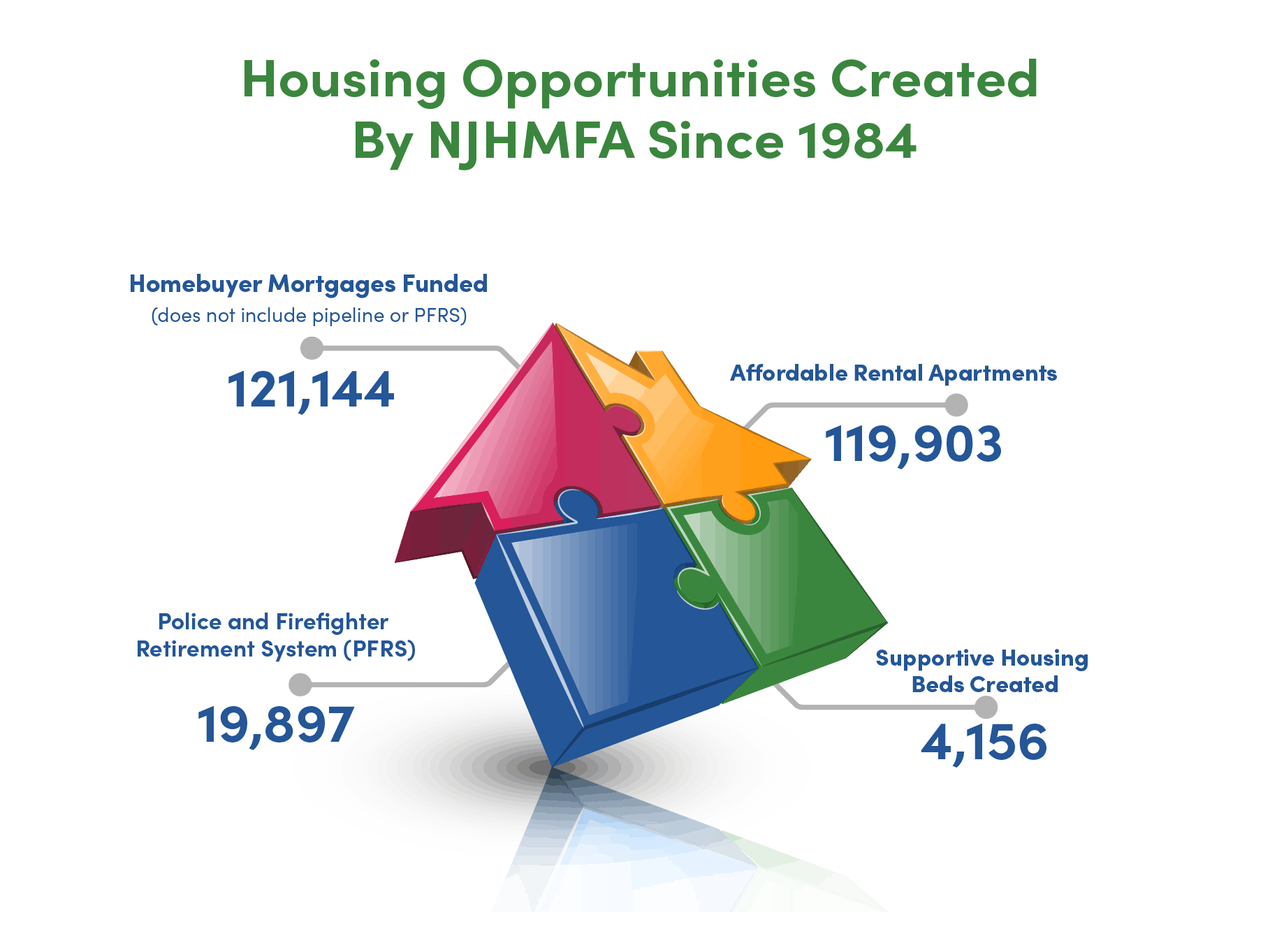

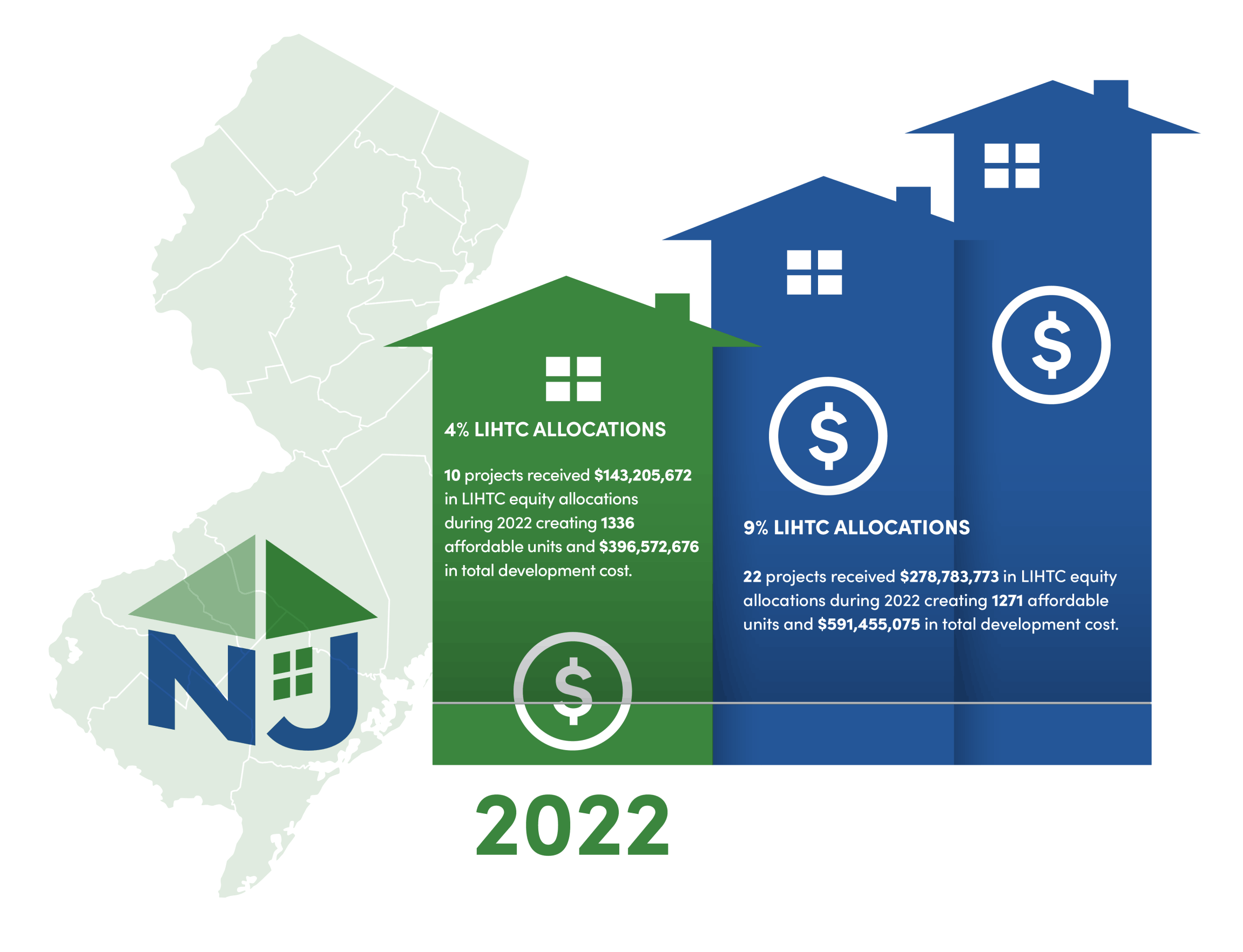

During 2022, NJHMFA awarded Low-Income Housing Tax Credits (LIHTC) to

32 new projects, generating $421,989,445 in equity. NJHMFA’s LIHTC awards

led to the creation of 2,607 affordable units with a total development cost of $988,027,751. NJHMFA also financed seven projects through the conduit

bond program, which will preserve another 1,163 affordable units.

Additionally, to advance administration housing policy priorities, NJHMFA established multiple new programs and amended the Special Needs Housing

Trust Fund Guidelines to maximize the impact of all targeted subsidy dollars, producing 269 special needs beds in 2022 alone. $40 million in Affordable Housing Gap Subsidy Program (AHGS) funds were allocated to offset increased construction costs and to bridge funding gaps resulting from the pandemic and supply chain disruptions. This program is supporting 23 projects in the creation

of 1,300 affordable units. Given the success of these targeted interventions,

an additional $60 million in subsidy has since been authorized to address

project needs in 2023.

NJHMFA's $25 million hurricane relief Capital Improvement and Assistance Program (CIAP) expansion was also a major success. The program rapidly addressed Hurricane Ida distress in the multifamily housing space,

making these efforts first-in-the-nation interventions.

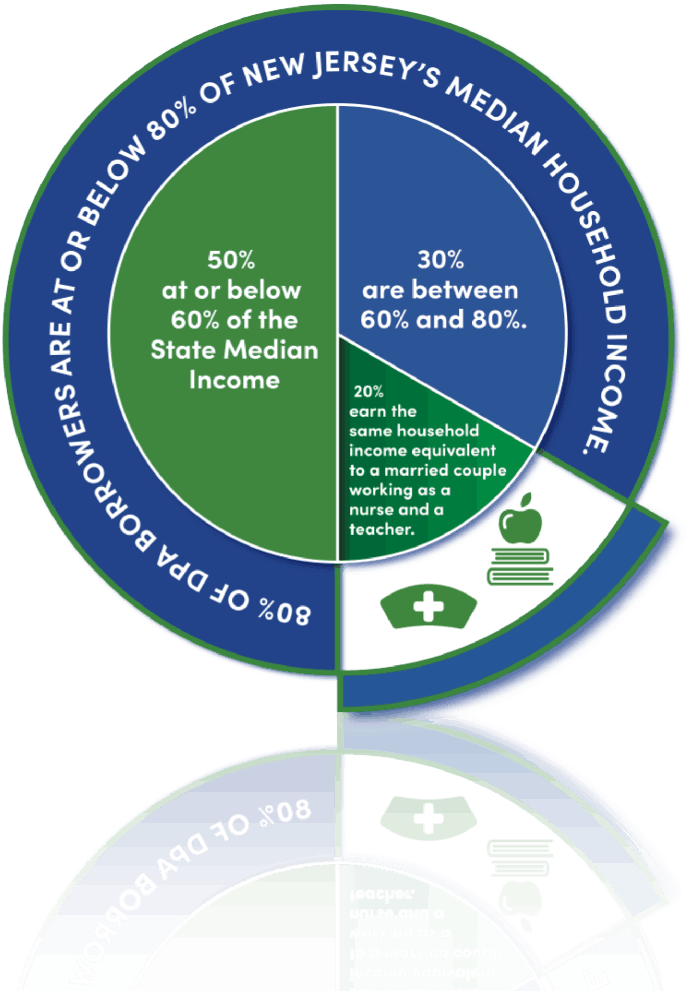

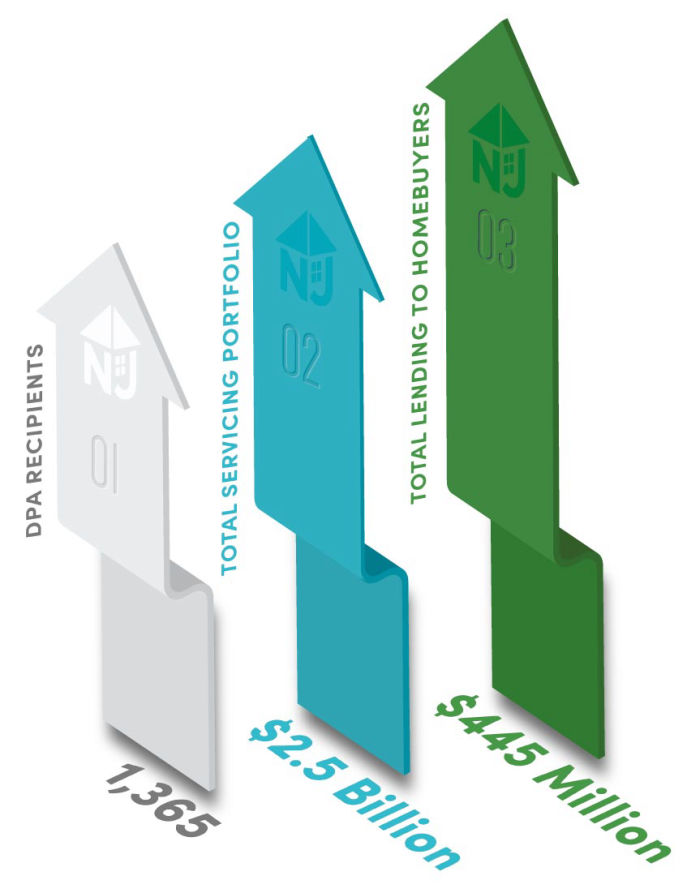

Beyond these multifamily initiatives, NJHMFA has made excellent progress in advancing homeownership opportunities across New Jersey. For families

looking to buy a home, saving enough money for a down payment is a considerable hurdle, one that grows higher as rents, grocery bills, and home prices continue to climb. That is why NJHMFA worked with the Governor and the Legislature to increase the annual budget allocation for the Down Payment Assistance Program from $20 million to $25 million. This investment in New Jersey

first-time homebuyers allowed the Agency to increase down payment assistance to $15,000 in counties where housing prices have increased the fastest so that first-time home buyers aren't priced out of the market, while retaining a

$10,000 DPA in areas where that remains sufficient to support down payment needs. NJHMFA has also been able to use a portion of these funds to support

rate buy-downs, helping to make our mortgage interest rates more competitive for first-time homebuyers, thereby saving them hundreds of dollars each month.

These programmatic changes and the expansion of NJHMFA's programming

to include conventional mortgage products have spurred rapid growth of the NJHMFA market share, particularly in the state's high-cost-of-living communities. In 2022, NJHMFA administered nearly 2,000 first mortgages, providing over $435 million in new home loans for low- and moderate-income first-time homebuyers. Cumulatively, NJHMFA has expanded first-time homebuyer opportunities at a time when the national share of homes purchased by first-time homebuyers dropped from 34% in 2021 to 26% in 2022. But, most importantly, each of those mortgages supported a family's attainment of the American dream. NJHMFA is honored to support these families and pleased to report that the Agency has supported a far more diverse and lower-income borrowing population than

other mortgage institutions, even in this most challenging of homebuying markets.

While NJHMFA is excited to support the growth of homeownership opportunity, the Agency is also mindful of its responsibility to support those in need of help

to retain their homes. New Jersey homeowners who have been financially affected by COVID-19 are able to apply for up to $75,000 per household to help bring their mortgages and other housing-related expenses current through the Emergency Rescue Mortgage Assistance (ERMA) program. ERMA deploys federally allocated Homeowner Assistance Funds to assist eligible homeowners who have been financially affected by COVID-19. In 2022, NJHMFA awarded more than $30,000,000 to more than 1,200 families.

With all this in mind, NJHMFA invites you to join the Agency in 2023 in reflecting on the many faces of affordable housing. Affordable housing serves countless friends, family members, and neighbors: nurses, essential workers, senior

citizens, young families, recent graduates, and many more. NJHMFA is

dedicated to supporting programs and developments that advance each

New Jersey resident's quality of life and afford individuals and families

new opportunities to thrive here in the Garden State. NJHMFA looks forward

to continuing to advance this mission with its partners in the year ahead.